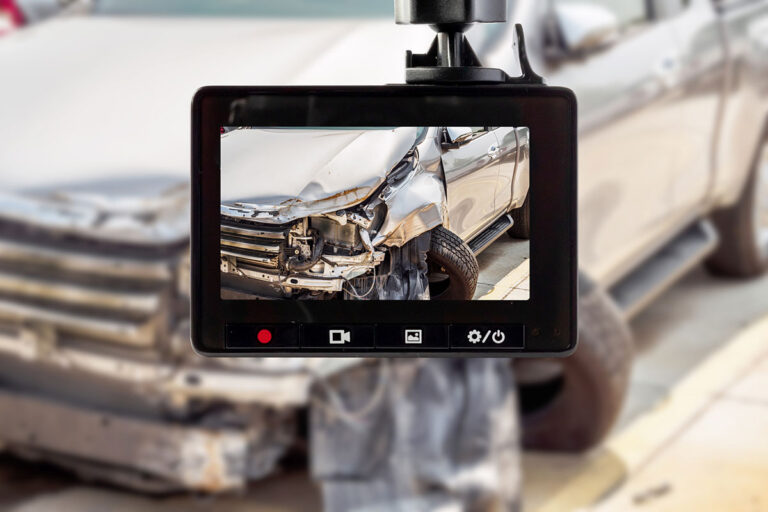

Injured In a Car Crash?

Even a minor car accident can throw a person’s life off track. If you were injured in a car crash in Ohio, our car accident lawyers at Slater & Zurz are ready to investigate what happened, explain your rights, and fight to get you the full compensation you deserve.

Even a minor car accident can throw a person’s life off track. If you were injured in a car crash in Ohio, our car accident lawyers at Slater & Zurz are ready to investigate what happened, explain your rights, and fight to get you the full compensation you deserve.

Experienced Ohio Car Accident Lawyers on Your Side

| Car accidents happen every day, but that doesn’t make the experience any less overwhelming. Whether the crash involved a distracted driver, a speeding vehicle, or someone who ran a red light, the physical and emotional fallout can be immense. From fender benders to life-altering collisions, our attorneys have seen it all. We help people involved in:

|

| Why Ohioans Turn to Slater & Zurz’s Car Accident Lawyers For over 30 years, our Ohio car accident lawyers have recovered millions for clients across the state, helping them move forward after some of life’s most difficult moments.

|

What Can You Recover in a Car Accident Lawsuit?

Every case is different, but we typically pursue compensation for:

- Medical bills (past and future)

- Lost income and reduced earning ability

- Pain and suffering

- Emotional distress

- Property damage

- Long-term rehabilitation or disability

- Wrongful death damages (in fatal crashes)

How Long Do You Have to File a Car Accident Claim in Ohio?

Under Ohio law, the statute of limitations for car accident injury claims is generally two years from the date of the accident. For wrongful death cases, it’s two years from the date of death.

There are exceptions and complexities, so don’t wait. A quick consultation can clarify your timeline.

While driving on a spring day in Summit County, our client was struck head-on by an uninsured drunk driver. The collision left the client with internal bleeding, multiple fractures, and ongoing sleep issues, along with bruises, abrasions, and lasting trauma.

When the insurance company encouraged the client to settle the claim without an attorney, they reached out to Slater & Zurz instead. We identified a potential bad-faith claim and took the case to mediation, ultimately negotiating a $217,500 settlement, which was nearly double the insurer’s initial offer.

Qualified Legal Representation for your Car Accident Claim

Navigating through the car accident claims process can be challenging. It is both stressful and frustrating dealing with the insurance company’s tactics, knowing their goal is to get you to settle for less than what you deserve. But you do not have to go through this process alone. We are qualified and ready to take the burden off of your shoulders, so you can focus on recovering from your injuries.

With over 100 years of collective experience, you can rest assured you have a knowledgeable and dedicated legal team on your side.